A recent report from PitchBook Data Inc. indicates a cautiously optimistic forecast for U.S. venture capital-backed initial public offerings (IPOs) in 2026. While the IPO market has opened to a degree, it remains considerably constrained.

In 2025, liquidity conditions showed marked improvement, with a select few high-profile IPOs providing necessary exit value and rekindling some confidence in public markets. Despite this, the recovery in the IPO space has been limited, as only 48 companies went public in the past year. PitchBook asserts that this level of activity is insufficient for a complete recovery in the venture market, especially as over $4.3 trillion remains tied up in private unicorns—companies valued at $1 billion or more. Following four consecutive years of negative cash flows to limited partners, the urgency to secure profitable exits is intensifying.

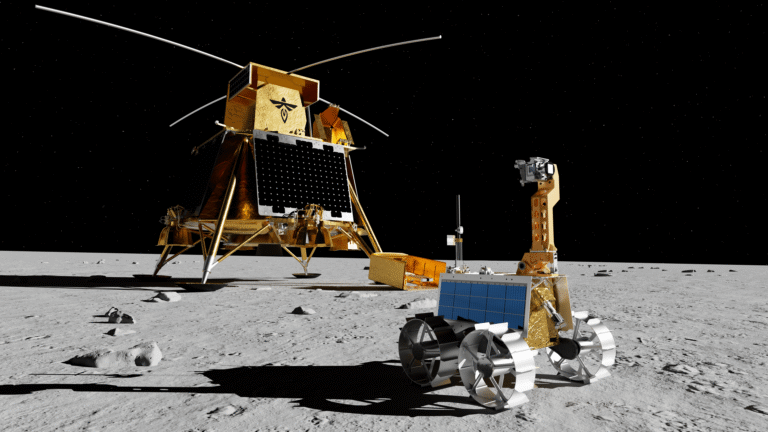

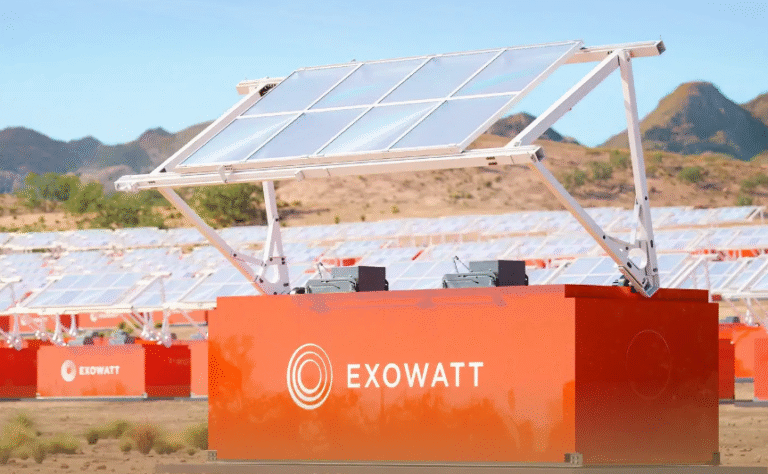

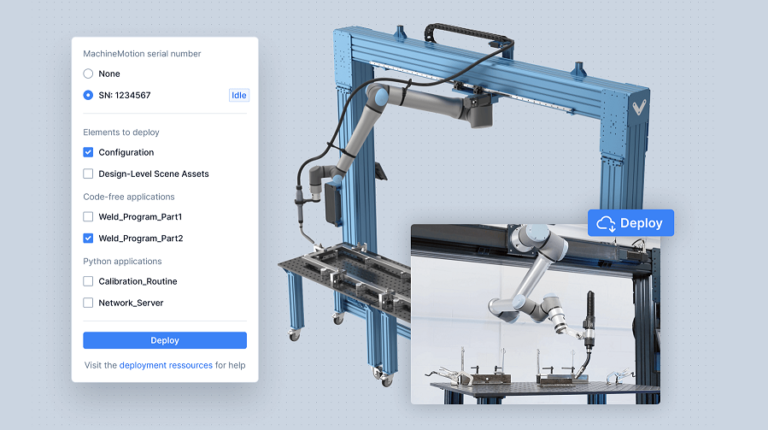

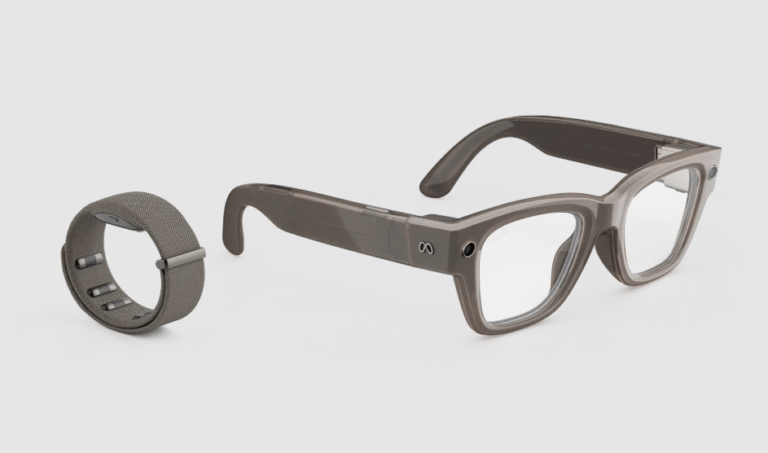

The report emphasizes that the IPOs of 2025 were notably selective, influenced by macroeconomic uncertainties and political events that complicated the timing and pricing of offerings. The majority of significant listings concentrated in sectors that align with U.S. policy priorities, including artificial intelligence, space tech, cryptocurrency, fintech, and defense. Over 73% of IPOs, excluding the healthcare sector, fell into these categories.

PitchBook anticipates this trend will continue into 2026, with an ongoing emphasis on policy alignment and sector-specific focus affecting which companies can successfully navigate to the public market.

A notable trend identified in the report is value compression, where many unicorns entering the public sphere did so at substantial discounts compared to their peak private valuations. While this shift may be challenging in the short term, it is viewed as a necessary step toward stabilizing the market, easing the path for future liquidity, and paving the way for a more sustainable long-term recovery.

For those firms that did go public in 2025, performance varied significantly; nearly 70% were trading below their initial day’s closing price by year-end, and almost half fell beneath their IPO price. Only four AI companies managed to end the year above their listing price, highlighting the intense competition high-growth firms face against established tech giants.

Unsurprisingly, the most successful IPOs were those of companies that demonstrated profitability before listing. Among these profitable firms, half saw their stocks rise at least 45% above their IPO price by the end of the year, reinforcing the importance of solid financials over mere growth aspirations.

Looking ahead to 2026, PitchBook projects a gradual increase in IPOs rather than a swift rebound. Assuming favorable conditions, including reduced policy uncertainty and further interest rate reductions, IPO activity could rise to approximately 68 offerings in 2026, marking a modest improvement over 2025. Conversely, unfavorable conditions could leave listings stagnant near current levels.

According to Emily Zhang and Kyle Stanford from PitchBook, “2026 has the potential to become a pivotal year for IPOs.” They note that while incremental progress is expected, whether this pace will be sufficient for a full market recovery remains uncertain. Continued subdued IPO activity could challenge the sustainability of the current venture ecosystem, as pressure mounts to convert unrealized gains into tangible returns.