Trump Media & Technology Group Corp. (TMTG) has announced an impending merger with TAE Technologies Inc., a pioneering company specializing in fusion reactor development. Valued at an impressive $6 billion, this all-stock agreement aims to create a balanced ownership structure, dividing equity equally between TMTG, which is a venture partially owned by former U.S. President Donald Trump, and TAE Technologies.

TMTG initially entered the public sphere last March via a merger with a special purpose acquisition company (SPAC). The firm operates the Truth Social platform and manages a sizable $2.5 billion fund aimed at investing in digital assets like Bitcoin. However, TMTG reported a significant net loss of $54.8 million last quarter, with revenue standing at just $972,900.

On the other hand, Foothill Ranch, California-based TAE Technologies is also facing financial challenges, reporting a third-quarter loss of $54.8 million and holding $166 million in cash assets. This merger could provide TAE with access to TMTG’s substantial $3.1 billion balance sheet, effectively extending its financial prospects.

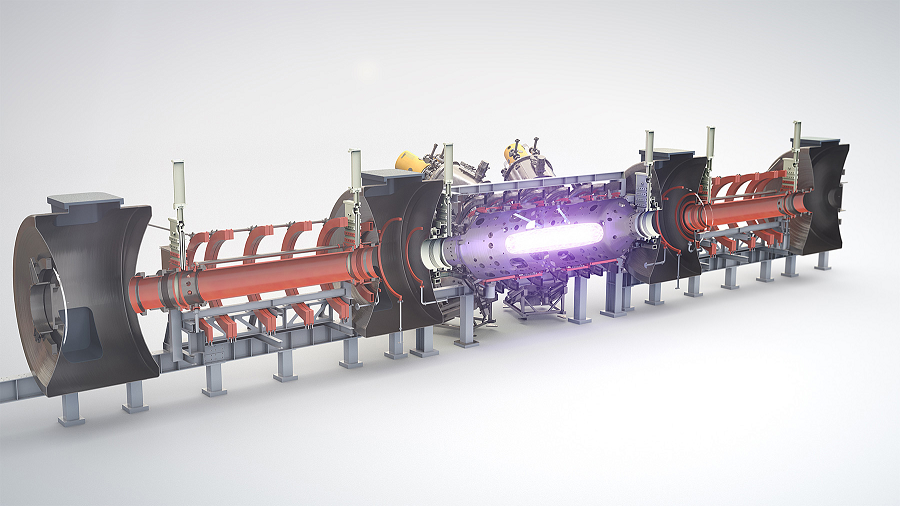

TAE is focused on a unique fusion reactor design known as the advanced beam-driven field-reversed configuration, which employs multiple particle accelerators. This system is touted to offer improved efficiency compared to traditional fusion reactors. Unlike conventional nuclear reactors that operate by splitting nuclei, fusion energy involves the combination of light atomic nuclei, resulting in energy release from the slight mass difference.

Despite the promise of fusion energy, current commercial applications remain elusive due to significant technical barriers, primarily the challenges of achieving the necessary conditions to facilitate nuclear fusion. TAE’s innovative reactor utilizes hydrogen and boron as fuel, transforming it into plasma contained by a strong magnetic field, further enhanced by the plasma’s self-generated magnetic properties.

Surrounding the reactor, an array of particle accelerators works to stabilize the magnetic field. The operational capacity of this technology includes power management systems capable of delivering up to 750 megawatts of electricity in less than a millisecond.

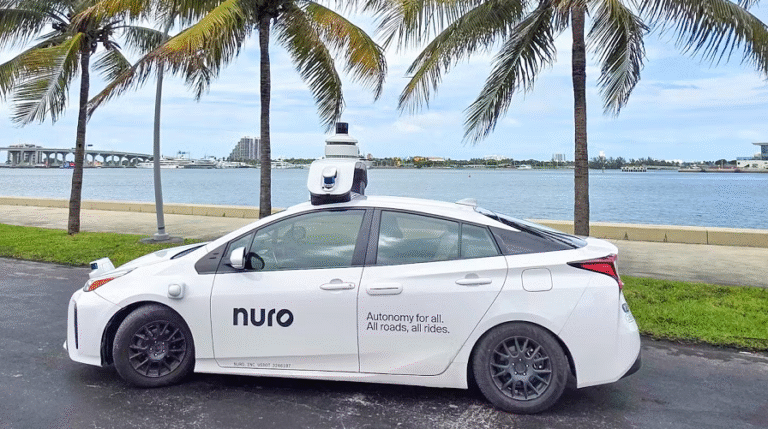

In a bid to diversify its applications, TAE spun off TAE Life Sciences in 2017 to explore medical uses for its technology. TAE Life Sciences is actively developing a compact particle accelerator intended for radiation therapy in hospitals, having recently partnered with the U.K. Atomic Energy Authority for commercialization.

TMTG and TAE anticipate finalizing their merger by mid-2026, coinciding with TAE’s plans to commence construction on a 50-megawatt fusion power plant. Future goals include expanding capacity with an additional 500 megawatts.

Key Points:

– TMTG merges with fusion developer TAE Technologies for $6 billion.

– Equal ownership structure between TMTG and TAE shareholders.

– TMTG operates Truth Social, has $2.5 billion for digital investments.

– TAE specializes in advanced fusion reactor designs and is loss-making.

– TAE aims to utilize hydrogen-boron plasma for electricity generation.

– Completion of the merger expected by mid-2026 alongside a new power plant project.