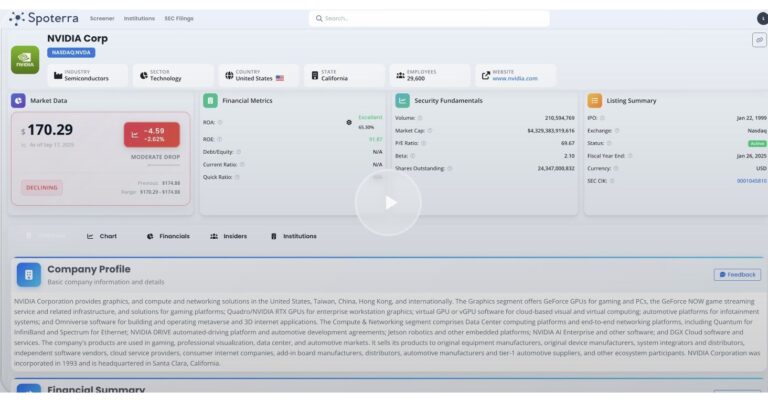

Investors have infused $230 million into Positron, a Reno-based startup, in a Series B funding round aimed at bolstering its position in the competitive AI chip market. Notably, the Qatar Investment Authority (QIA) participated in this funding, reflecting its growing emphasis on expanding AI infrastructure.

This capital influx occurs at a pivotal time when major tech players and AI companies are seeking to diversify their supply chains away from Nvidia, a longstanding industry leader. Among these companies is OpenAI, which has expressed dissatisfaction with some of Nvidia’s recent AI chips and has actively sought out alternatives since last year.

Positron’s funding strategy aligns with broader industry movements, including a $20 billion joint venture with Brookfield Asset Management focused on AI infrastructure, announced in September. With this latest round, Positron has raised over $300 million in total since its founding three years ago. Prior funding included $75 million from prominent investors like Valor Equity Partners, Atreides Management, DFJ Growth, Flume Ventures, and Resilience Reserve.

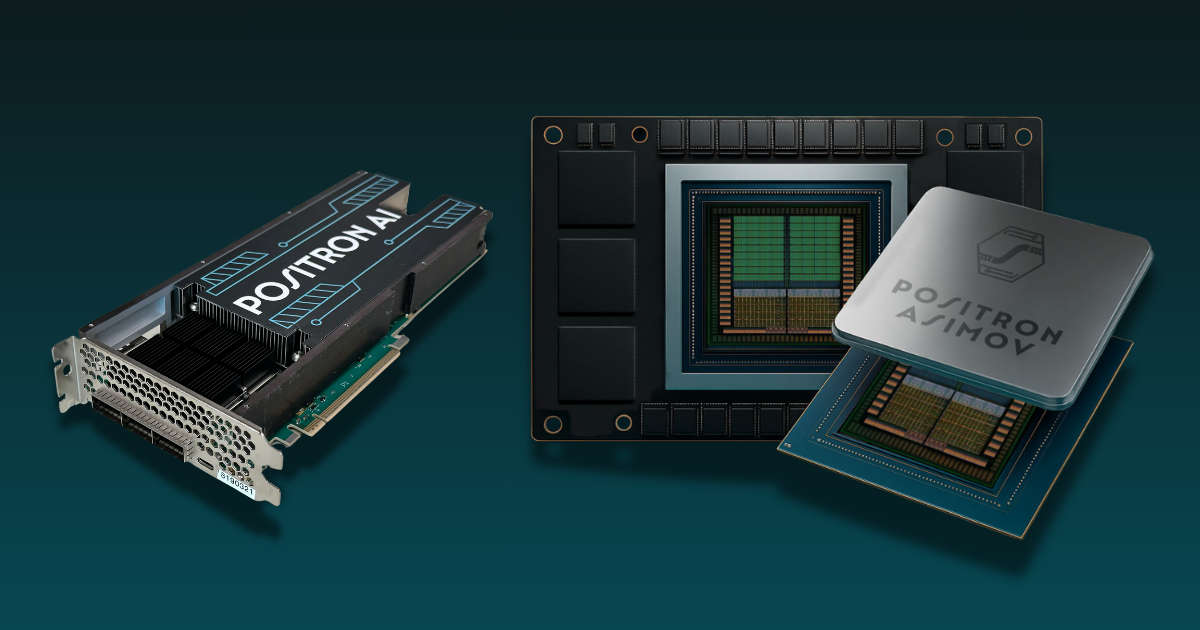

The startup’s first-generation chip, dubbed Atlas, is manufactured in Arizona and claims to deliver performance comparable to Nvidia’s H100 GPUs while consuming less than one-third of the power. Positron is strategically focused on inference, the crucial computing process for deploying AI models in practical applications, as the industry pivots from training extensive language models to scaling their real-world applications.

Key Highlights:

– $230 million raised in Series B funding led by QIA.

– Total capital raised by Positron now exceeds $300 million.

– Focus on AI inference over traditional training models.

– Atlas chip designed to outperform in efficiency compared to Nvidia’s offerings.