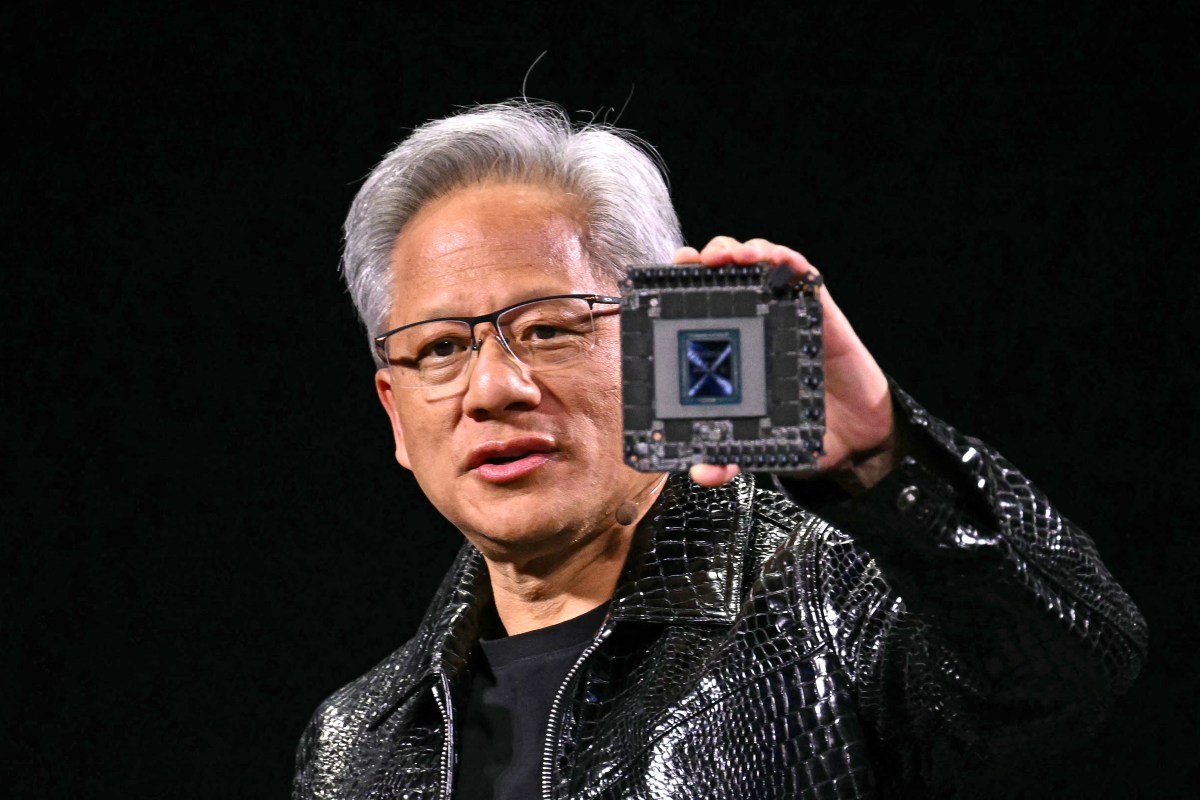

Nvidia Injects $2 Billion into Synopsys to Enhance Semiconductor Design Capabilities

Nvidia has announced a significant $2 billion investment in Synopsys, a company specializing in software solutions for semiconductor chip design. This move not only strengthens their ongoing collaboration but also addresses growing concerns surrounding potential overvaluation in the AI sector, as analysts evaluate the increasing prevalence of interconnected deals within the industry.

Through this investment, Nvidia will acquire Synopsys shares priced at $414.79 each, forming a multi-year partnership aimed at incorporating Nvidia’s advanced AI hardware and computing technologies into Synopsys’s electronic design automation (EDA) and simulation software. This initiative is expected to facilitate Synopsys’s transition from traditional CPU-based computing to GPU-centric workflows, enhancing the efficiency of chip design processes.

Key implications of the investment include:

-

Boosting Stock Value: The transaction has positively impacted Synopsys’s stock prices, suggesting a robust outlook for future growth amidst recent struggles in its intellectual property (IP) segment, which faced challenges due to U.S. export restrictions and difficulties experienced by a major client.

-

Strengthening Market Position: For Nvidia, this strategic investment bolsters its control over Synopsys’s widely-utilized EDA tools, enhancing its competitive stance as the race for semiconductor innovation intensifies.

This partnership emerges as key players in the investment community, including SoftBank and Peter Thiel, have recently divested from Nvidia, marking a pivotal moment in the tech landscape.