IonQ Inc. has announced its intention to acquire SkyWater Technology Foundry Inc. for a substantial $1.8 billion, a move that highlights the growing intersection of quantum computing and advanced semiconductor manufacturing. SkyWater, established in 2017 from a former Cypress Semiconductor division, specializes in producing cryogenic control electronics essential for the operation of quantum computers—an expertise that likely influenced IonQ’s decision.

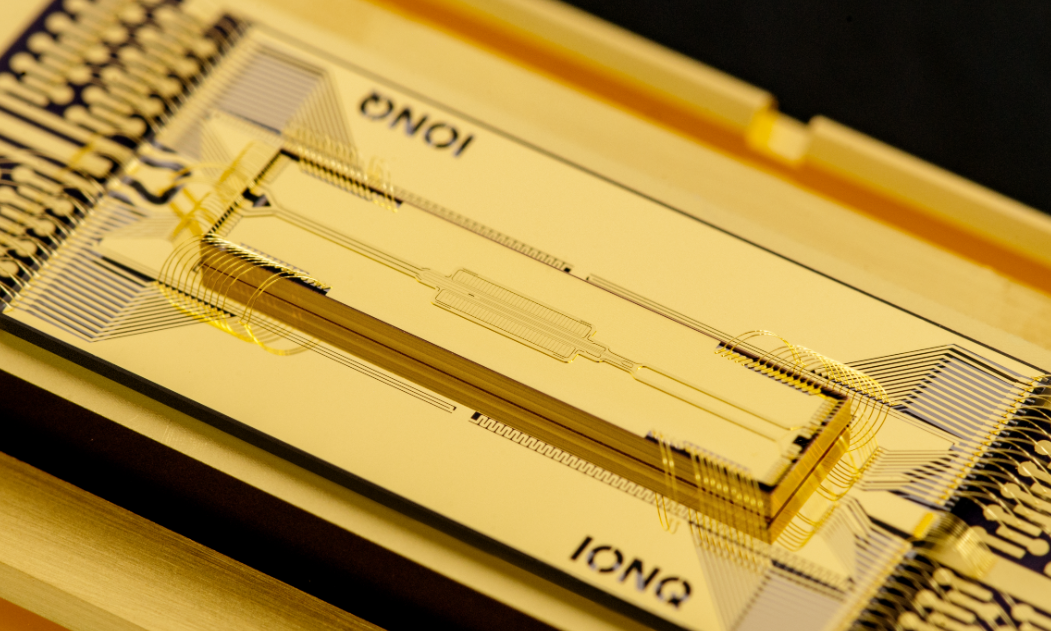

As a publicly traded entity on the NYSE, IonQ develops quantum processors that leverage ions, the electrically charged atoms. This acquisition comes on the heels of a $1.075 billion agreement to purchase Oxford Ionics Ltd., another key player in the quantum chip sector that employs ions as qubits. Notably, both companies benefit from SkyWater’s capabilities in creating cryogenic control electronics, which can enhance the functionality of quantum systems.

SkyWater’s manufacturing facilities not only cater to quantum technology but also produce components for fiber-optic networks and automotive systems, indicating the company’s diverse technological reach. Its flagship Texas facility boasts over 91,000 square feet of cleanroom space dedicated to chip fabrication, along with a 30,000-square-foot area for testing new designs. SkyWater employs 65-nanometer technology, which, though not cutting-edge, offers cost-effective solutions compared to other modern nodes used for high-performance processors.

IonQ anticipates that this acquisition will significantly expedite its quantum hardware development, enabling parallel prototype testing and reduced iteration times for silicon wafers. The company has set its sights on testing a 200,000-qubit processor by 2028. “This partnership will enhance engineering pathways for next-generation quantum chips, fostering greater speed and precision,” remarked SkyWater CEO Thomas Sonderman.

After the deal is finalized, SkyWater plans to promote IonQ’s quantum sensors and network products to its existing clientele. This includes advanced appliances capable of securing data through post-quantum cryptography, while IonQ’s sensors can measure various system parameters.

SkyWater will continue manufacturing chips for a range of clients, potentially including competitors in the quantum hardware space. Investors in SkyWater are set to receive $15 in cash and $20 worth of IonQ stock per share, with the acquisition expected to complete in the second or third quarter of this year.

In summary, this strategic acquisition positions IonQ to bolster its quantum computing capabilities through enhanced manufacturing infrastructure, while also opening avenues for collaboration with diverse sectors.