Shares of Tesla Inc. experienced a modest increase in after-hours trading after the company surpassed expectations for its fiscal fourth-quarter performance. CEO Elon Musk unveiled significant changes intended to redefine Tesla’s mission beyond just electric vehicle production.

In the quarter ending December 31, Tesla reported adjusted earnings per share of 50 cents, a decline from 73 cents in the same quarter of 2024. Revenue stood at $24.9 billion, representing a 3% year-over-year decrease. However, both figures exceeded analysts’ predictions of 45 cents per share and $24.78 billion in revenue. The non-adjusted net income for the quarter reached $840 million, bolstered by stronger margins and record energy storage installations. While vehicle deliveries surpassed 418,000 units, this was lower than the previous year and fell short of investor expectations.

Tesla’s full-year revenue totaled $94.8 billion, marking the company’s first annual decline in history. The decline in profits was attributed to decreased vehicle sales, especially in competitive markets like Europe and China.

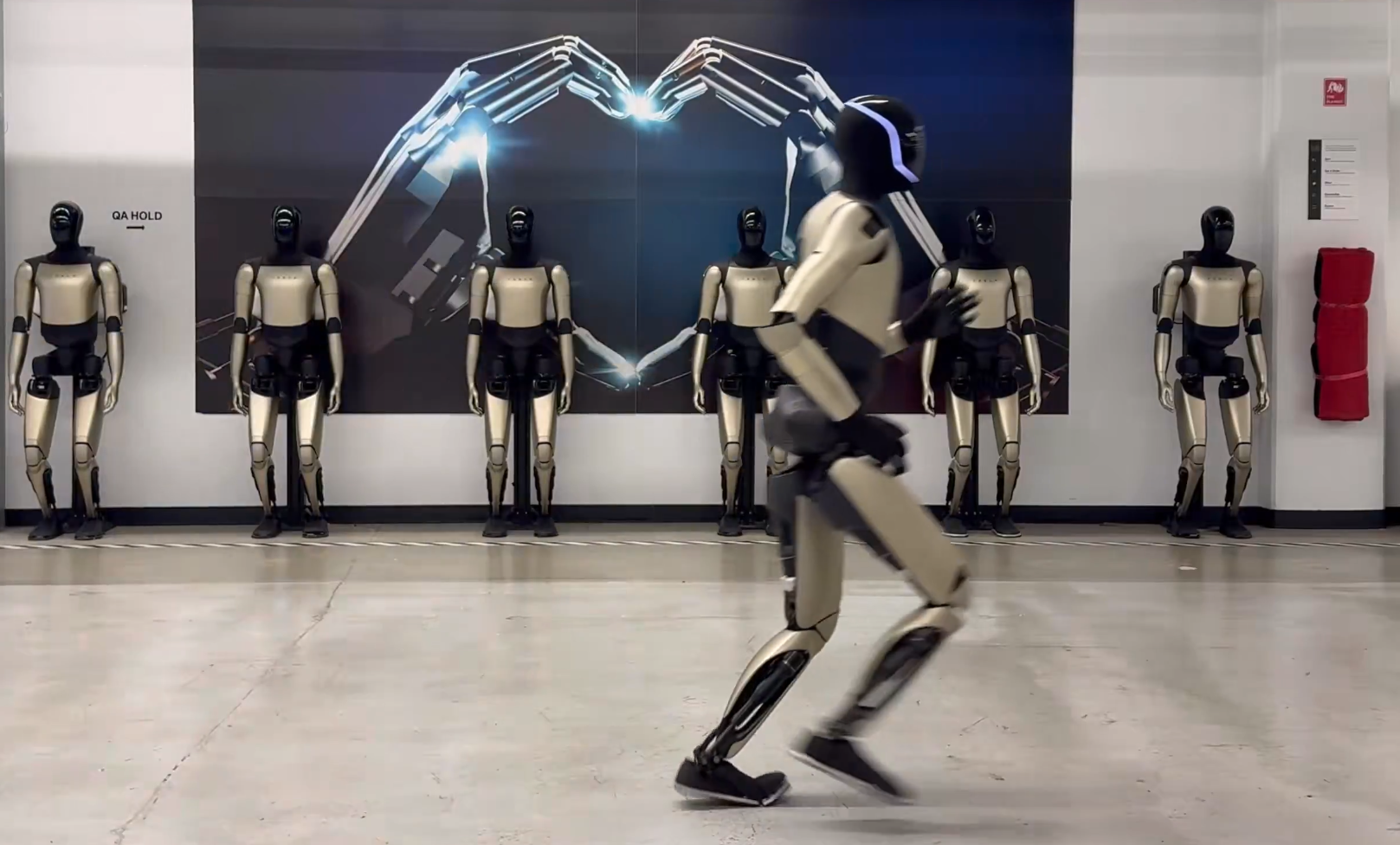

In a pivotal moment during the investor call, Musk outlined Tesla’s strategic transition towards robotics, aiming to evolve from a traditional electric vehicle manufacturer to what he termed a “physical AI company.” This transition will begin with the halt of production for the long-standing Model S and Model X vehicles. The company plans to redirect available capacity at its Fremont factory to develop Optimus humanoid robots and future autonomous vehicles, effectively transforming Fremont into a hub for robotics and autonomous innovation.

Tesla is expected to reveal the third-generation Optimus robot in the upcoming months, with production slated to commence before the end of 2026 and mass-market availability targeted for 2027. Additionally, Musk announced a $2 billion investment in xAI Inc., his artificial intelligence endeavor, indicating tighter integration between Tesla’s AI systems and its physical products.

Despite the optimistic pivot towards robotics, Musk acknowledged potential near-term challenges, including margin pressures, supply chain uncertainties, and softening demand for electric vehicles in certain areas. Tesla also anticipates significant capital expenditures exceeding $20 billion in 2026 to enhance manufacturing capacity, AI infrastructure, and robotics facilities.

While prioritizing robotics, Tesla remains committed to its vehicle lineup, with the Tesla Semi and Cybercab set to enter production in the first half of this year, alongside the next-generation Roadster.